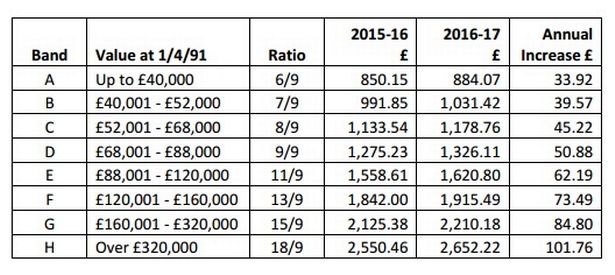

I’m having to investigate Capital Allowances on our Zetland House purchase, with a view to exploiting them ourselves on an ongoing basis and the valuation of any future sale.

This is a complex and, dare I say, crushingly dull affair. However, if it saves money, it makes you money and this article has provided me with the most illuminating overview so far. Perhaps the best advice in this article is to get a Capital Allowances specialist in your Power Team.

https://www.taxation.co.uk/Articles/2014/04/08/323051/good-bad-and-ugly